Commerical Real Estate Investing

Key-stone (noun)

: A wedge-shaped stone at the apex of a masonry arch or typically round-shaped one at the apex of a vault. In both cases it is the final piece placed during construction and locks all the stones into position, allowing the arch or vault to bear weight...and scale.

Dustin Eller

Commercial Real Estate Visionary | Broker | Entrepreneur

Tony Greene

Seasoned Investor | Diverse Portfolio | Property Management Pro

Dustin Eller is a dynamic force in the world of commercial real estate, blending the roles of investor, broker, and entrepreneur with remarkable finesse. With an unwavering passion for the industry, Dustin has established himself as a trusted authority and a go-to resource for clients seeking unparalleled real estate expertise.

As a savvy investor, Dustin possesses a deep understanding of the intricacies of the commercial real estate market. Over the years, he has meticulously curated an impressive portfolio that encompasses various commercial property types, from office spaces to retail centers and industrial complexes. His keen eye for opportunities and a knack for identifying emerging trends have consistently yielded lucrative returns on his investments.

Dustin's commitment to excellence extends beyond his role as an investor. He is also a highly accomplished commercial real estate broker, guiding clients through the complexities of property transactions with a blend of professionalism and personalized service. His in-depth market knowledge, coupled with his dedication to client success, has earned him a sterling reputation in the industry.

Not content with merely being a broker and investor, Dustin is a true entrepreneur at heart. He is the proud owner of his own commercial real estate brokerage, a testament to his visionary leadership and unwavering commitment to delivering top-notch services. Under his guidance, the brokerage has flourished, becoming a go-to destination for clients seeking expert guidance in buying, selling, and leasing commercial properties.

Outside of his professional pursuits, Dustin enjoys spending quality time with his wonderful wife, Nikki, and their three-legged rescue chiuahuha, appropriately named, Tripod. His multifaceted approach to life reflects his ability to balance the demands of entrepreneurship, investment, and brokerage with a zest for life's many facets.

Dustin Eller is the embodiment of innovation and success in the world of commercial real estate. Whether you are a seasoned investor, a business owner seeking the perfect commercial space, or someone looking to unlock the potential of your property, Dustin's expertise, integrity, and entrepreneurial spirit make him the ideal partner to turn your real estate aspirations into reality.

With over two decades of experience, Tony is a seasoned real estate investor who has navigated the ever-evolving landscape of the industry with finesse. His journey in real estate began over 20 years ago, and since then, he has crafted a well-balanced portfolio that showcases his versatility and expertise.

Tony's portfolio spans a wide spectrum of real estate assets, including residential properties, commercial spaces, multi-family units, and a strong focus on industrial properties. His ability to diversify and adapt to various sectors within the real estate market has been a key driver of his success.

In addition to his impressive real estate holdings, Tony is also the proud owner of a property management company. This venture reflects his commitment to not only acquiring properties but also ensuring their optimal performance and value. With a property management company under his belt, Tony is prepared for any challenge that may arise in the dynamic world of real estate.

Tony's dedication to the industry, coupled with his unwavering commitment to excellence, has earned him a reputation as a true real estate expert. Whether it's identifying lucrative investment opportunities, managing properties efficiently, or staying ahead of industry trends, Tony's knowledge and experience make him a trusted figure in the world of real estate.

When he's not immersed in the world of real estate, Tony enjoys traveling with his wife (and realtor), Lindsay Greene, and spending time with their French Bulldogs, oh yeah, he is also the owner/chiropractor of Brixton Chiropractic, founded in 2006. His multifaceted approach to life is a reflection of his ability to balance diverse aspects, just as he does in his real estate endeavors.

Connect with Tony today to tap into his wealth of real estate wisdom and discover how his expertise can help you achieve your property investment goals.

Fund X - Tulsa, OK:

- Property: 104,028 sqft industrial warehouse on 3.11 acres

- Units: A (74,428 sqft) and B (31,600 sqft)

- Acquisition: November 2022

- Lease: 10-year Absolute NNN lease signed at acquisition with 2% yearly rent increases

- Cost: $3,830,510, Raised: $1,000,000

- Unit B Sale: Currently selling for $1,762,500, generating a 76% return for investors in 12

months

- Unit A Market Entry: Bringing to market in December 2023 for $4,500,000 at a 7% CAP

- Exit: Investors expected to have a combined return of 231% in 1.5 years

Fund TX - Savoy, TX:

- Property: 88,470 sqft industrial warehouse on 10.03 acres

- Occupancy: 100%

- Acquisition: February 2023

- Lease: 10-year Absolute NNN lease with 3% yearly rent increases

- Security Deposit: Negotiated at $750,000, with $350,000 retained by Keystone for CapEx,

returning $100,000/year to tenant

- Cost: $3,700,000, Raised: $875,000

- Holding Period: 3-5 years, planned sale at 7% CAP for $5,750,000

- Exit: Investors expected to have a combined return of 189% in 5 years

Click to see next slides

, LLC.

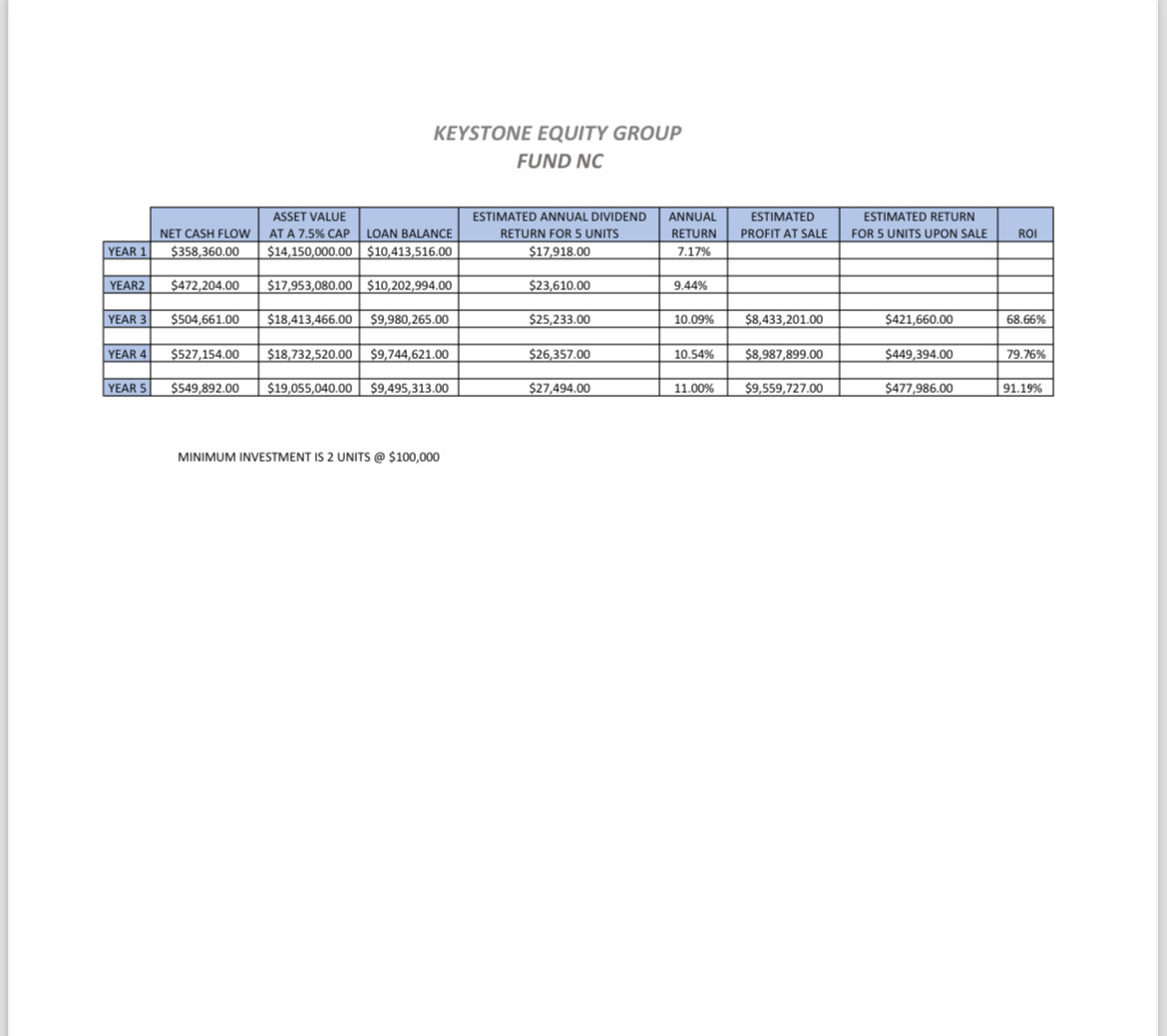

Keystone Equity Fund, NC

Membership Units

Capital Investment

Non-Voting Units Offered: 80 Incentive Units owned

by Keystone Equity, LLC: 20

Price Per Unit: $50,000 Minimum Investment: $100,000

(2 Units)

$4,000,000

Incentive Shares to Keystone Equity, LLC – 20 units

Manager – Keystone Equity, LLC

Property Management Fee – 6% of Annual Gross Income Asset Management Fee –

< Waived By Keystone Equity >